ON THIS PAGE…

Insurance can be complicated, but it doesn’t have to be. In this post, we’ll take a look at vacation rental insurance for owners and review some of the best practices for making sure you and your home stay protected.

Note: Short-term rental (STR) and vacation rental are terms used interchangeably to refer to a vacation home that will be used primarily as a rental property.

What is STR Insurance?

In general, the goal of insurance is protection. People buy insurance based on one question: “What if?”

“What if someone breaks the rules and brings pets or smokes inside the house?

“What if someone breaks or steals something in my vacation home?

“What if someone breaks the rules and brings pets or smokes inside the house?

Insurance products are built around these what-if scenarios. And while many providers supply these products, that’s not what’s most important (that is, who’s supplying the insurance).

What’s more important is what exactly is being covered. You want to make sure you and your home are protected in a comprehensive and cost-effective way.

One consideration to be aware of is this: not all protection is created equal.

In other words, instead of trying to find a one-size-fits-all product, it may suit you better to construct a ‘plug and play’ plan that fits your unique needs as an owner or investor. After all, everyone has their own preferences when it comes to risk management.

The best vacation rental insurance for owners includes three essential layers of protection:

- Personal Liability Protection

- Third-Party Liability Protection

- Contents Damage Protection

An optimal vacation rental insurance plan includes a multi-layered approach that utilizes legal and financial mechanisms in conjunction with your rental operation, ensuring that you’re in a favorable position if you ever find yourself in the crosshairs of a claim.

Personal Liability Insurance

Personal liability protection refers to insurance that covers you as a person. As such, your liability to guests may not be limited to the short-term rental property you own but can actually extend to include unrelated assets if you’re not careful.

Create Separation with a Limited Liability Company

Setting the home up as an LLC creates separation between your vacation rental and the rest of your life. If something happens at your VR and someone comes after you (i.e., slip and fall), you don’t want unrelated assets getting thrown into the mix.

Creating an LLC is the first step of distancing yourself from the risk that comes with hosting guests at your vacation home.

What to do:

- Create an LLC

- You, the homeowner, will lease the property to said LLC

- The LLC will hire the management company to manage the property

In effect, the relationship is between the manager and the LLC you’ve created (vs. the manager and you).

The costs of LLCs are pretty nominal when compared to the benefits. Especially in a worst-case scenario, commissioning a separate entity is more than worth the price of admission.

After you’ve created some separation, you need to make sure to fortify it by acting accordingly. That means segregating financials, communications, and other things so there’s always a clear line between the two entities.

Upgrade Your Homeowner’s Insurance

This is one of the most critical components of vacation rental insurance for owners.

You may compare different insurance products from different companies but whichever company you decide to go with, you’ll want to consider whether a beefed-up residential policy is best suited for your needs or if you’d be better off with a commercial policy (more on that below).

What does STR insurance cover?

In addition to the Personal Liability mentioned above, you may also want to consider General Liability which usually comes standard with all commercial policies.

The key difference between a commercial policy and a residential policy is increased coverage (and with it, added cost). While commercial policies tend to be a bit more expensive, they are intended to cover commercial activity which, if your goal is to maximize your income, will likely be a better fit for your vacation rental.

Commercial policies also tend to include a “Loss or Interruption of Business” clause, which pays you a percentage of your expected revenue if, for some reason, you can no longer host reservations (i.e., a disastrous weather event).

With a commercial homeowners insurance policy, you get more comprehensive coverage and diminishing marginal costs as occupancy increases at your short-term rental property.

In other words, the more successful your vacation rental, the more nominal the cost of insurance.

The Best Vacation Rental Insurance for Owners

When we scouted out different vacation rental insurance providers, we found there were few companies that provided 360-degree protection for our homeowners.

We searched long and hard for the best plan because we want our owners to feel at ease knowing they’re protected if anything goes wrong. One of the best options we found is a company called Proper Insurance.

Proper’s vacation rental insurance for owners is essentially three policies in one. It has components of a homeowners policy, a landlord policy, and all the basics of a commercial business policy.

After all, operating a short-term rental property on a full-time basis is like a small business in itself, so why not get the best coverage to protect your business?

Something else we like about Proper is that they’re extremely accessible.

The motto they built their brand on is, “Just call Proper.” Whenever you have a question or concern about coverage or potential scenarios that keep you up at night, you can make a quick call or send a simple email and they’ll respond right away with an answer.

Like Savvy, they provide personalized, professional service that makes owning a vacation rental much easier.

How much does STR insurance cost?

Vacation rental insurance costs will vary for owners based on many factors but, in general, you can expect to pay somewhere between $2,000 to $5,000 per year for a comprehensive plan.

However, commercial coverage isn’t the only solution here. Depending on your risk tolerance, you may opt to stick with a residential policy. Particularly in the case where you’re only renting your vacation home occasionally, you may decide that you feel protected enough with your current plan.

Regardless of how often you plan on renting, you’ll want to confirm with your agent that you’re protected if and when you rent your home to travelers. Simply send an email to your agent to get something in writing.

Here’s a script you can copy/paste into your email (feel free to revise as needed):

If I regularly entrust my property to paying vacation rental guests for a period of less than 30 days, and those guests damage, steal, or are injured at my property, will I be covered?

The idea here is to get something in writing that says you’re covered.

At that point, you can decide for yourself if it’s worth adding more coverage or changing your policy altogether. If you’re not covered, at least you know it upfront instead of finding out when it’s too late.

Add Special-Purpose Policies to Fill Gaps

The best vacation rental insurance for owners will also depend on where the property is located. Different regions pose different risks to your short term rental property. Things like tornadoes, earthquakes, floods, and mudslides are all more or less likely to happen based on the local geography. So you need to make sure your plan accommodates these gaps.

Most homeowner policies will have exclusions or limitations that leave you in a vulnerable position (i.e., unforeseen weather events, “Acts of God”).

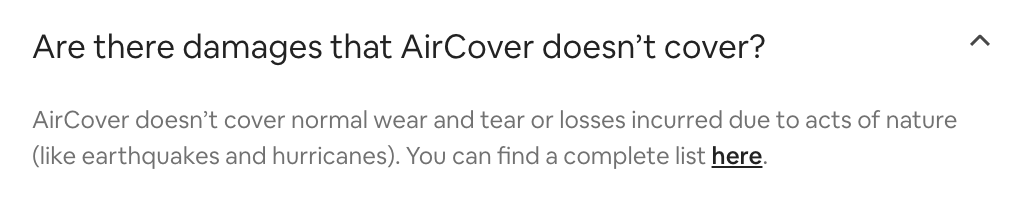

An example of exclusions and limitations

That’s where special-purpose policies come in. These are specific insurance products that fill the gaps of your main policy and safeguard you against these risks.

To obtain gap coverage, you can find a local insurance agent familiar with the specific risks associated with your property’s location; someone who can understand your current coverage and recommend additional policies best fit for you and your vacation home.

These insurance products tend to be pretty affordable because, statistically speaking, the scenarios they cover aren’t very likely to happen.

Another option to consider is an “umbrella” policy that serve as a general fail-safe against coverage gaps and exclusions.

Whichever route you decide to take, you’ll want to make sure defense costs are included in all your policies so that you don’t have to come up of pocket for attorney fees should you ever go through the legal process.

Third-Party Protection

Third-party protection is provided by the marketplaces where you advertise your vacation rental property. Platforms like AirBnB and VRBO, otherwise known as online travel agencies (OTAs), offer “protection” for hosts that covers specific liability and damage claims.

Having used these platforms for years, we’ve been lucky enough not to encounter anything we couldn’t recover from. However, in our experience, we’ve seen that these larger corporations have priorities that don’t necessarily put our owners at the top.

And with a little digging around, you’ll find some of the horror stories that prove this to be true. Not to mention the sudden changes that you’re vulnerable to on these platforms.

So while it’s reassuring to have this additional layer in your insurance stack, it’s not something that you’ll want to rely on as your primary means of protection.

Actually, if something serious does happen at your short-term rental property, this insurance would be your first line of defense. If it’s not resolved through the third-party platform, you know that you’ve got a few more layers to fall back on.

Damage Protection Insurance

Finally, an optimal vacation rental insurance plan for owners should cover all the contents inside your short-term rental property.

What happens when Jane Doe and her family stay at your home and break something? Before they showed up, the TV was working and there weren’t any problems. After they left, the TV doesn’t work because there’s a crack in the screen.

The manager calls Jane to see what happened and she says, “I have no idea. It wasn’t us.”

There are a few ways to handle these circumstances but only one of them is conducive to protecting the future of your vacation rental business.

Option 1: Chase the guest for money

The frustration that comes with handling disrespectful guests is not uncommon. Actually, it’s pretty normal to ask guests to pay for something they broke or ruined. Whether or not they do is a different story entirely.

Reasonable guests are those who understand the situation and work with you to reach a fair resolution. Unreasonable guests, however, will go to great lengths to make you work for these recovery costs, often at the detriment of your business.

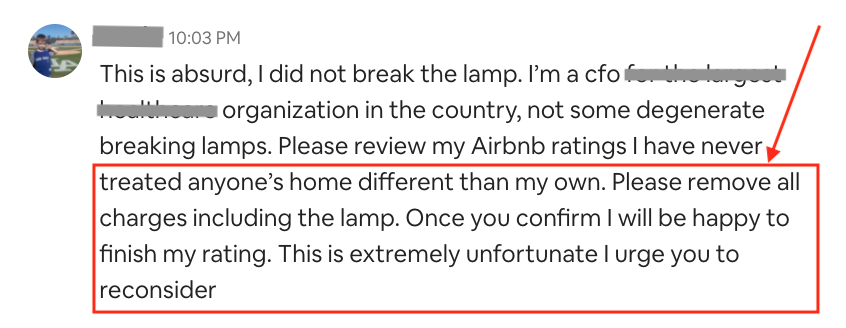

Some guests will even threaten you with bad reviews:

The impact of negative reviews on your business is often multiples more than the cost of damages, and the guests who know this may use it against you.

Option 2: Pay for it yourself (or don’t fix it at all)

When you’re not adequately prepared, it comes down to the question of, “Who’s going to pay for this?”

Some homeowners opt not to charge guests and decide to cover the costs themselves. In this case, these damages are paid for directly from the rental revenue, which eats into your bottom line as an owner. This approach may benefit the guest, but it doesn’t necessarily benefit you.

On the other hand, homeowners may decide not to fix or replace whatever it was that got broken or damaged. In most cases, this ends up negatively impacting the experience for future guests and ultimately eats into the top line.

So this option is ultimately a lose-lose all around…

Option 3: Budget for contingencies

Alternatively—and dare we say, the savviest approach—you can budget for these incidentals knowing that they’re inevitable. Being savvy means being resilient, and being resilient often requires a certain level of foresight and, subsequently, preparation.

Having run the numbers on your short-term rental property, you can budget incidentals into your forecast to prepare for unexpected situations. A good start would be 3-5% of rental income.

So if you plan to earn $1,000 per month, take $30-50 from your income each month and put it into a separate account (or simply record it on a ledger). When something breaks, you just pay for the replacement from these savings.

You can also decide to incorporate some (or all) of this cost into your rate strategy. In other words, you can bake it into your nightly rates or add an extra fee so that guests are helping fund your incidentals account.

The great part about this option is that you don’t have to involve the guest. This makes damage recovery much more straightforward.

If you hire a professional property management company, they should already provide this kind of coverage for you. The best vacation rental managers will include damage protection for every guest reservation so your valuables are protected from accidents.

Savvy’s full-service property management has you covered with up to $2,500 in damage protection insurance for each reservation. If something breaks, gets lost, or stolen, it only takes a few minutes to submit a claim and we get you paid in a matter of days.

Conclusion: Your Optimal Insurance Stack

When it comes to vacation rental insurance for owners, it’s not a matter of if something will go wrong, it’s a matter of when.

Whether you already own or plan on purchasing a vacation rental property, insurance is not something you want to drag your feet on. Would you rather learn the hard way, or be proactive and put a plan in place before you find yourself in a pickle?

To optimize your protection, make sure your plan includes the following:

- Personal coverage (business structures and/or special-purpose policies)

- Property coverage (homeowner’s insurance, commercial or standard)

- Contents coverage (third-party platforms and per-booking plans)

Savvy Vacation Rental Management takes a multi-layered approach to make sure you and your home are fully protected. This approach comes from extensive research and various best practices adopted throughout the hospitality industry, from property management to claims specialists to litigation attorneys.

Note: Savvy VRM is a property management company, not an insurance agent or insurance provider. Please consult a certified insurance professional before choosing a policy and protection plan.

Have a Question About Vacation Rental Insurance for Owners?

We’ve done our best to provide you with all the information you need to best protect yourself if you plan to manage a short-term rental property. But if there’s something we missed, or something you’re curious about, just fill out the form below and we’ll follow up within 24 hours.