ON THIS PAGE…

The key to understanding vacation rental property management fees is realizing that not all companies are created equal. There are many variables that determine what fees are charged and what you, the owner, get paid at the end of the day.

If you’re on the hunt for a property management company, this post will shed some light on vacation home management fees so you know what to expect while you’re calling around.

What are Vacation Rental Property Management Fees?

Vacation rental property management fees are the costs associated with services provided by professional management companies. These fees are usually one of the biggest deciding factors when determining which company you’ll hire so it’s important to understand what they are and how they work.

Basically, when you work with a vacation home rental agency, you’ll pay them to take care of your short-term rental operations. This is no different than the landscaping company or the person who takes care of your pool: you pay them to do a specific service for your property.

The specific service a management company provides will differ slightly with each one you speak to. Most companies will advertise a single fee for their services and that fee is structured in a particular way.

Types of Vacation Rental Management Fees

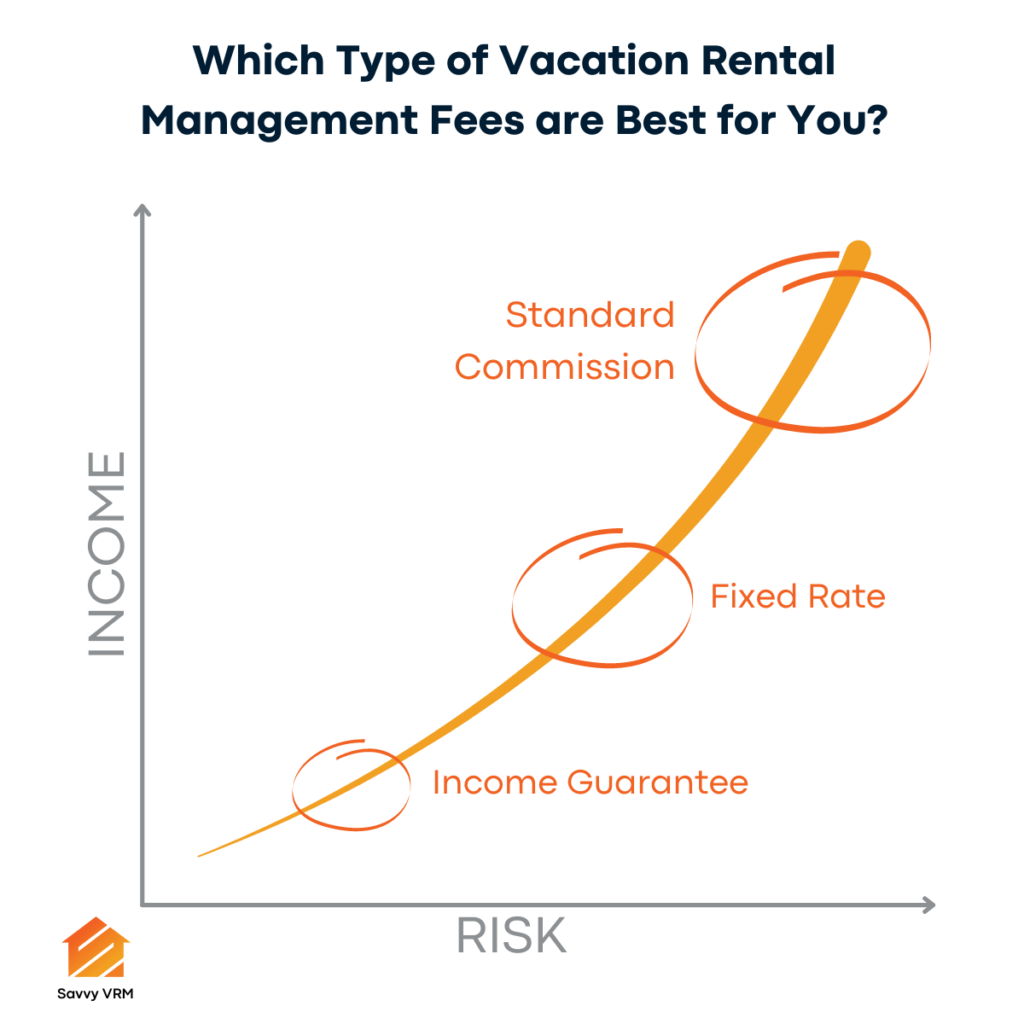

There are a few different ways that vacation rental management fees are structure. The pricing model for each company is generally a result of business strategy and reflects the company’s goals and vision for how they want to serve owners or investors.

The three main fee structures are:

- Commission-based (or Revenue Share)

- Income Guarantee (or Rental Arbitrage)

- Fixed Monthly Rate (or Flat Fee)

Depending on your investment style and personal preferences, one type of property management fee may fit you better than another.

Let’s take a look at each of these to understand the differences…

Commission (or Revenue Share)

The most typical type of property management fees are commission-based. This means the management company will charge a commission based on a percentage of all the income generated by the short-term rental property.

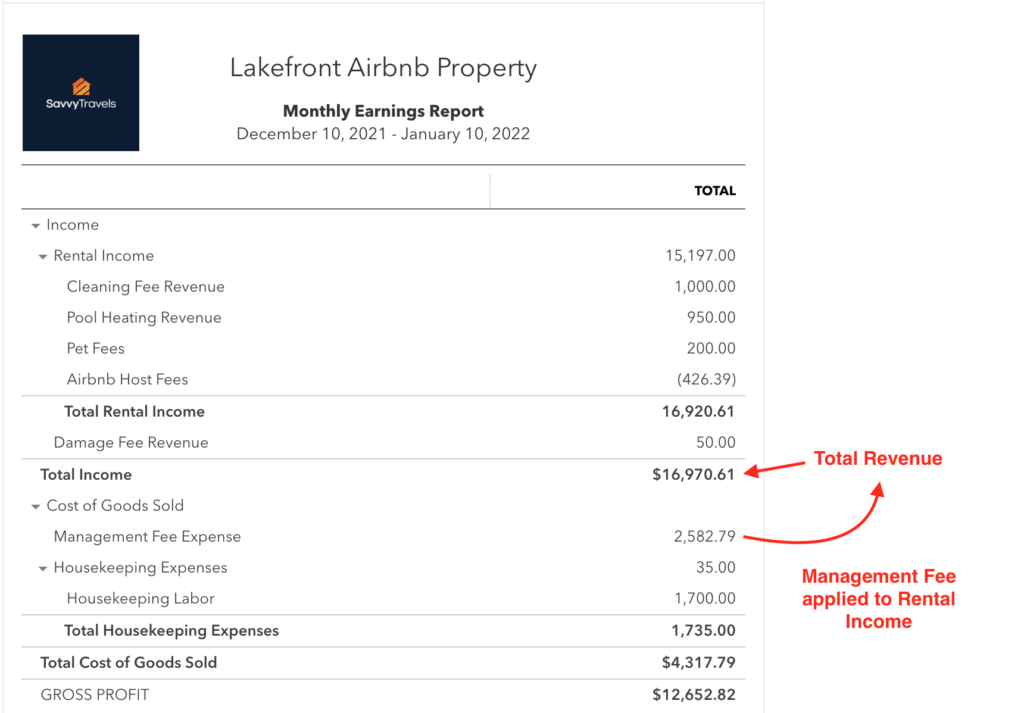

In this model, the percentage is applied to Gross Rental Revenue (GRR), or the “top line” of the financial statement. For example, if the property’s GRR is $10,000 in a given month, and the vacation rental management fees are 20%, you’ll end up paying the management company $2,000 that month.

A slight variation on this structure is the Revenue Share model in which a specific percentage is applied, but rather than charging a fee based on the top line, the fee is taken from the bottom line instead.

In both of these models, monetary incentives are aligned because the management company will only make money when the property makes money.

However, the latter model takes this alignment a step further by putting a spotlight on the company’s operating performance. Knowing that their cut is taken from the bottom line, managers using this model are incentivized to increase operational efficiencies and minimize unnecessary spending.

While the Revenue Share model is more common amongst investment partners who share equity in the property, it may be worth asking a company if that’s an option for you.

Income Guarantee (or Arbitrage)

Another way companies structure their vacation rental management fees is by guaranteeing the income you’ll receive every month. In this model, you get the certainty of a specific dollar amount, however, the tradeoff is the upside potential of more income.

As an example, let’s say the long-term rental market indicates you can command a rent of $2,200 per month for your property. Your overhead is about $2,000 so that leaves you with $200 monthly cash flow…

But then you hear that short-term rentals are getting more popular in your area and you start calling around. A professional property management company offers you a guaranteed income of $2,500 to use your home as a vacation rental. Fantastic! You’ve just doubled your profit on this investment property by making a few phone calls.

This pricing model makes more sense if you’re risk-averse.

Short-term rental investment properties tend to be more volatile, and not everyone likes that kind of volatility. If that sounds like you, this fee structure might be the way to go.

When the property encounters a tough month (or a tough few months, like in highly seasonal markets), the management company eats the loss—not you. However, the company also takes the gains during the good months. The property might only earn $1,500 during the slow season but it might also earn $6,000, $10,000, or even more during high season.

With this model, you’re basically exchanging a higher sense of security for lower profits.

A slight variation on this model is what’s called Rental Arbitrage. This means a management company will sign a long-term lease as a tenant of your property and pay the same rates of a long-term tenant, with the caveat that they can use it as a short-term rental property.

Again, with the arbitrage, you get security and don’t suffer any losses if something happens with the travel industry, or with the short-term rental regulations in your city.

Fixed Monthly Rate (or Flat Fee)

While the first two types of vacation rental property management fees are priced for full-service companies, you may also be considering hiring some help that isn’t a management company.

Maybe it’s a virtual assistant, a college student, a freelancer, or your son-in-law. In any case, this kind of fee structure is usually much lower and acts more like any other independent contractor you might hire for the home (i.e. cleaners, handymen, etc.).

Their services are generally more limited, but they get the job done. In exchange, you pay them a flat rate per month, say $500, to take care of certain things like guest communications, check-ins, and managing the rates calendar.

While this is a low-cost alternative to a professional management company, keep in mind that this option may also prevent you from realizing the full potential of your short-term rental investment property.

Various pricing models exist because owners have different needs and priorities.

While one owner values her time and happily pays a company to take care of everything for her, another owner prefers bootstrapping the vacation rental operation with a little help from an admin. It’s not that one of these options are better than the other, it’s just a matter of what fits best.

What’s the Typical Vacation Rental Management Fee?

As you’ve just learned, vacation rental property management fees are structured in many different ways. The structure depends on the company, and they’ll let you know up front what kind of pricing model they use.

The obvious next question is, “How much are vacation rental management fees?”

The industry pricing for full-service property management fees has a high degree of variance, ranging between 20-50% depending on the market and type of property.

At first glance, this may seem high, but you have to consider what these fees include. A true full-service management company will literally take everything off your plate so you only have to pay the basic bills each month (mortgage, utilities, etc.).

Operating a short-term rental property is actually a lot of work if done well, so it makes sense why owners are willing to pay these rates: they’d rather spend their time doing other things. After all, with a professional property management company, owners tend to make more money and do less work.

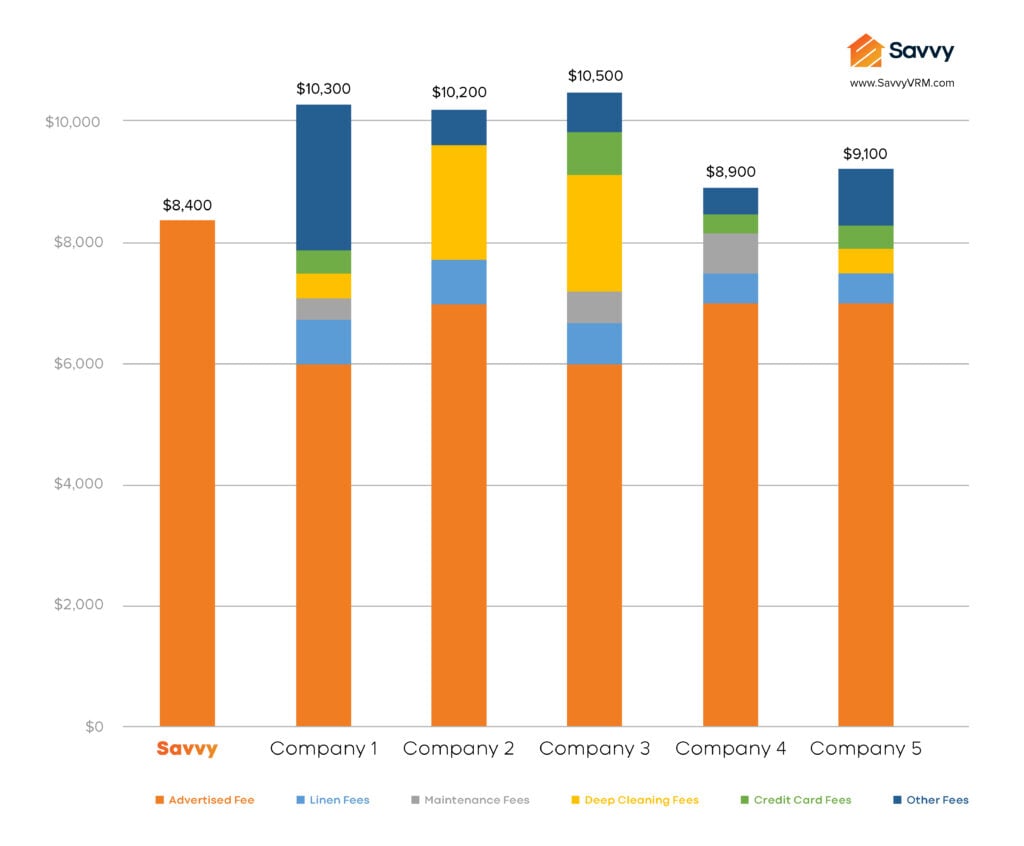

Where some owners have a bad experience, though, is when they sign up for full-service management and then see various other fees that they didn’t initially expect. In other words, the advertised rate that a company tells you may not be the complete picture.

What Does a Property Manager Do for a Vacation Rental?

It’s imperative that you understand all the services that are included in the vacation rental property management fees you’ll be paying. Actually, in some cases, it might be better to ask what’s not included in the fees. This approach may help simplify the conversation if you’re feeling overwhelmed and confused.

Something to be cautious of is companies that advertise extremely low fees (as in, significantly lower than other management companies in the area). They may quote you with a low rate but then add ancillary fees on top of that so, at the end of the month, their “industry-low” 10% actually turns into something closer to 20% of your overall revenue.

On the other hand, companies quoting you a higher rate are (hopefully) including everything in their fee. The following graph shows how these differences match up against each other at the end of the month…

When deciphering what property managers do for a vacation rental, it highly depends on their business model. A major corporate company like Vacasa operates differently than a company like Evolve, which are both different than a boutique vacation home rental agency like Savvy.

As mentioned above, each company is different and it’s up to you to find out which services are included and which are not. However, two of the most common services you’ll see when operating a short-term rental property is maintenance and cleaning. If nothing else, seek clarity on how these two specific expenses are handled by the management company.

Maintenance & Repair Fees

Maintenance and repairs are inevitable expenses for STRs. The question is, how does the management company charge for them?

Some companies may add a 10% (or higher) premium on top of the invoices they pay when using 3rd-party service providers. Or if they have an in-house team, they might pay their staff $20 an hour and bill you $50 an hour (a 150% markup).

Other companies might give you a monthly “cap” which, if exceeded, will result in additional fees being deducted from your payout. This acts as a kind of credit or allowance for repair costs so some months you may be under but other months you’ll be over.

At Savvy, there’s no surcharge or premium added to maintenance costs. We simply make the phone call and work with the repairman to get the job done whenever something urgent comes up. In this light, we’re like your personal vacation rental concierge that solves problems before you even know they exist.

Linens & Cleaning Fees

Every time guests stay at your vacation rental property, it needs to be cleaned. And not only that, the property must also be inspected and appropriately staged. This is called a “turnover” or “flip” in the short-term rental space.

When the Savvy team flips a property, we ensure it’s “guest-ready” which means the rental is completely prepared to deliver an extraordinary experience to incoming guests. There are many parts to this process, and many people involved in making the magic happen, and it’s all included in our full-service management fee.

Other companies may not include this cost in their management fee, which means it’s coming out of your pocket. Or they may include cleaning but charge extra for inspections and staging (if they even do that at all).

There are also some companies who offer a “Linen Leasing Program” for which you pay a certain rate per month to have them supply sheets for your vacation home. Depending on the market you’re in, and how many beds your vacation rental has, the numbers may or may not work out in your favor. Unless you’ve owned similar properties and can refer to historical data on supply costs, it’ll be hard to determine what the more cost-effective choice is.

Overall, it’s best to get an idea of every fee that will ever show up on your monthly statements so you can understand exactly what you’re going to be charged, and under what circumstances.

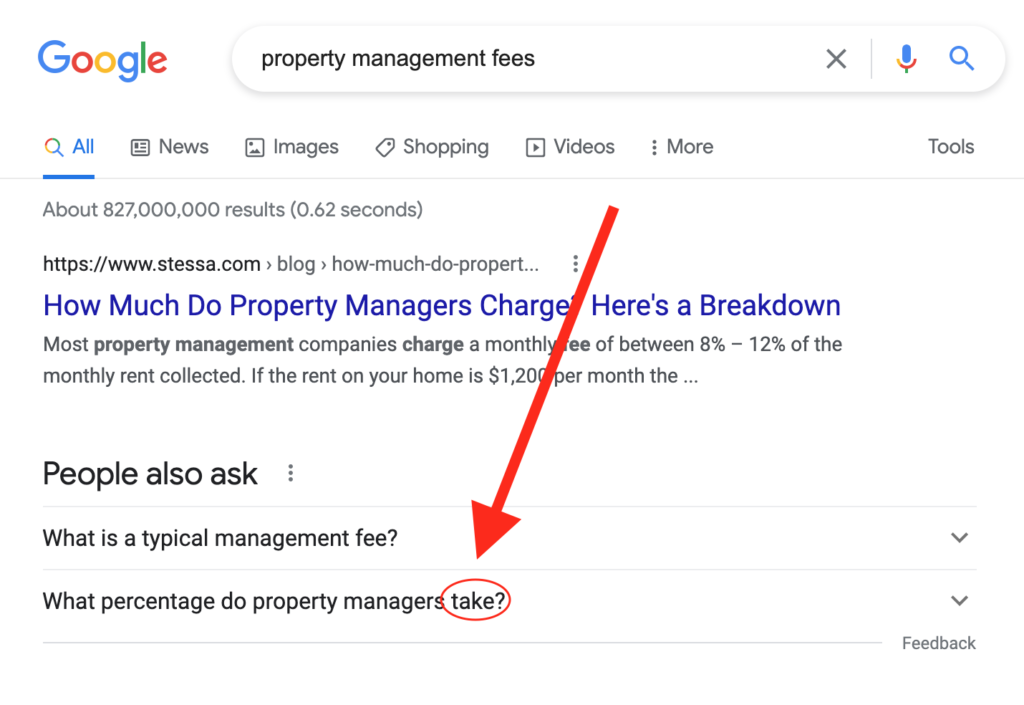

Don’t Focus on What Property Managers Take, Ask a Different Question Instead

In our experience with vacation rental management, one of the first questions homeowners and investors ask is, “How much do you charge?” This is especially true for those who have never worked with a management company before.

The problem is, that’s the wrong question to be asking…

This question not only blurs the comparison between management companies (because of the large variance in fee structures), but it also detracts from the overall value the company brings to your vacation rental property.

The irony is that owners and investors care about making money but they don’t seem too curious about how much more money they’d make with a management company compared to without one.

Instead, they place more emphasis on how much the company “takes” from their rental income. But at the end of the month, what’s more important: how much money the property management company takes, or how much money you make?

Instead of focusing on what percentage property managers take, there’s a better question to ask: “What’s your Average Net Margin?”

All things being equal, savvy owners and investors will prioritize the cash return they’ll be making when buying a vacation rental property. Net Margin is a metric that helps them understand this number with greater clarity.

If you ask a property manager about this number, you’ll be better equipped to determine how profitable your short-term rental property will be (with and without their help).

Determining ROI on Property Management Fees

Net Margin is the percentage of profit compared to the revenue earned. All property management companies will gladly give you an income estimate for your short-term rental. Once you find out their Average Net Margin, you can simply multiply that percentage by the income estimate they gave you to get an idea of what you’ll be taking home each month (or year).

For example, let’s say a management company estimates your property can earn $100,000 per year. If their Average Net Margin is 50%, you can estimate that you’ll earn about $50k a year (or just over $4k a month).

On the other hand, if you only ask what percentage the company takes (let’s call it 30%), you may be expecting to earning $70k a year. But this doesn’t account for any other expenses the property (or you) will incur.

Property management fees draw a close parallel to marketing expenses, which are part of nearly every business. It’s usually easy to judge whether the money spent on marketing is “worth it.”

For example, a productive marketing strategy will generate at least $2 of new revenue for every $1 spent. This is a 2-to-1 return, or a 200% return on investment (ROI).

If you spend $1 on marketing and only generate $1 of new business, you’re basically breaking even. And anything less than $1 of new business results in a negative ROI—which is just bad for business.

Similarly, when you look at the financials of your short-term rental property, you should be able to clearly distinguish how productive a management company is, and whether or not the management fees are “worth it.”

If you’re only focusing on the percentage the company is charging for its services, you won’t be able to clearly distinguish the added value.

Let’s look at it from another angle… Which property management company would you rather hire:

- The company that charges 10% and pays you $2,500 per month, or

- The company that charges 20% and pays you $5,000 per month?

When framed like this, the answer seems obvious, doesn’t it? From this angle, it’s also easier to understand that the question, “What percentage does a vacation rental company take?” might not be the best question to ask.

Net Operating Margin creates clarity around your property’s performance and lets you gauge how effective a management company actually is. And this doesn’t even factor in how much extra revenue your property will earn by working with a management company.

So when you start calling around, try changing your focal point, get curious, and lean into the numbers to find out which company is best for you.

Pricing for Savvy’s Property Management Services

At Savvy Vacation Rental Management, we pride ourselves on simple, straightforward pricing that’s honest, fair, and easy to understand. That’s why we offer one flat rate for full-service property management.

We use a commission-based model that ranges between 20-30% depending on the type of property you have and where it’s located.

Our vacation rental property management fees are structured in a way that not only meets our owners’ needs but also reflects how we got started as a company.

We created the below infographic to illustrate how our fees are structured and how the money flows when we manage your home:

To summarize:

- Guests pay a sum of money to Airbnb

- Airbnb deducts Service Fees and pays the rest to Savvy

- Savvy uses this money to pay all necessary parties involved, including contractors, government departments, and suppliers just to name a few

- Savvy charges a vacation rental property management fee for its services, then pays the remaining money (known as “Net Profit”) to the Owner

- The Owner then pays mortgage, property taxes, and utilities

This is how the cash flows for a typical Airbnb reservation. There are slight variations but this covers the gist of things. For example, in some markets, Airbnb will remit taxes directly to the city instead of the property manager (i.e. San Francisco).

Are Vacation Rental Property Management Fees Really Worth It?

When you buy a vacation rental, you basically have (3) three options:

- Do everything yourself

- Do some of the work and hire someone else to help cover the rest

- Do nothing at all and let a professional company take care of everything

Before starting Savvy VRM, we actually experienced the first two options ourselves. We started by managing just a single vacation rental property (also known as self-managing).

When friends asked us to manage theirs, the workload increased so we had to hire a little help to keep up. Eventually, we grew our management portfolio and decided to commit to vacation rental management full time.

So we understand all the work that goes into operating a successful STR property. We recognize that there’s a minimum workload that will get the job done, of course. But if you really want to unleash the full income potential of a vacation rental, you’ve got to do a lot more than the bare minimum.

Whether or not the vacation rental property management fees are “worth it” is for each owner to decide for him or herself.

Looking at the infographic above, if you wanted to do things on your own, you’d simply replace “Savvy” with “Owner” in #3, then delete #4 altogether.

You’d still have to make all the other payments to all the same people. In effect, you’re trading the management fee for your own time and effort in the day-to-day rental operation.

So in a sense, when you hire a professional management company, you’re not buying services—you’re buying time. A full-service property management solution gives you back your time so you can focus on more important things.

At Savvy, our pricing model is structured to reflect our role as a liaison for your short-term rental property. Our services take care of everything that you would have to do if you were running the vacation rental yourself. We’re not just a stand-in, though, we’re your personal Who that knows How.